Q: Is the 1099-K Threshold Change specific to PayPal and Venmo?

No. This is industry wide for all Third-Party Settlement Organizations (TPSOs) that you may use to accept payments for the sale of goods and services.

Q: When do these changes come into effect?

The 1099-K change will take effect January 1, 2022. PayPal and Venmo will be required to provide customers with a 1099-K form if they receive $600 or more in goods and services transactions during the 2022 tax year.

This means you will need to take into account the Threshold Change with your Tax Year 2022 filings. The In-flow and Out-flow change has not been considered by Congress yet and therefore doesn’t have an effective date.

Q: What is a Form 1099-K?

Form 1099-K is an IRS informational tax form used to report payments received by a business or individual for the sale of goods and services that were paid via a third-party network, often referred to as a TPSO or credit/debit card transaction. The IRS requires TPSOs, such as PayPal and Venmo, to issue a Form 1099-K, which shows the total amount of payments received from a TPSO in the calendar year. Taxpayers should consider this amount with their tax advisor when calculating gross receipts for their income tax return. For more information, visit the IRS website

here.

Q: What do I need to do in 2022 when the 1099-K Threshold Change takes effect?

You may notice that in the coming months we will ask you for your tax information, like a Social Security Number or Tax ID, if you haven’t provided it to us already, in order to continue using your account to accept payments for the sale of goods and services transactions and to ensure there aren't any issues when these changes take effect in 2022. This helps us meet our obligations to the IRS and ensures that you will be able to continue using your account and access PayPal and Venmo features and services.

For the 2022 tax year, you should consider the amounts shown on your Form 1099-K when calculating gross receipts for your income tax return. The IRS will be able to cross-reference both our report and yours.

Q: Haven’t I always had to declare my income from the sale of goods and services transactions? What's different?

Reporting and declaring any income, either personal or through a business, has always been a requirement when filing your taxes with the IRS. The change broadens the scope of reporting such that all TPSOs, like PayPal and Venmo, need to collect tax information once you near or reach $600 in goods and services transactions (instead of the prior threshold of $20,000 and 200 transactions), so that we can remain compliant with our regulatory requirements and share those details with the IRS.

This change impacts every financial institution and TPSO that you might use to transact for goods and services, not just PayPal and Venmo. This includes your bank accounts, and other ways you send and receive money.

Q: How does this 1099-K Threshold Change impact how I use PayPal and Venmo?

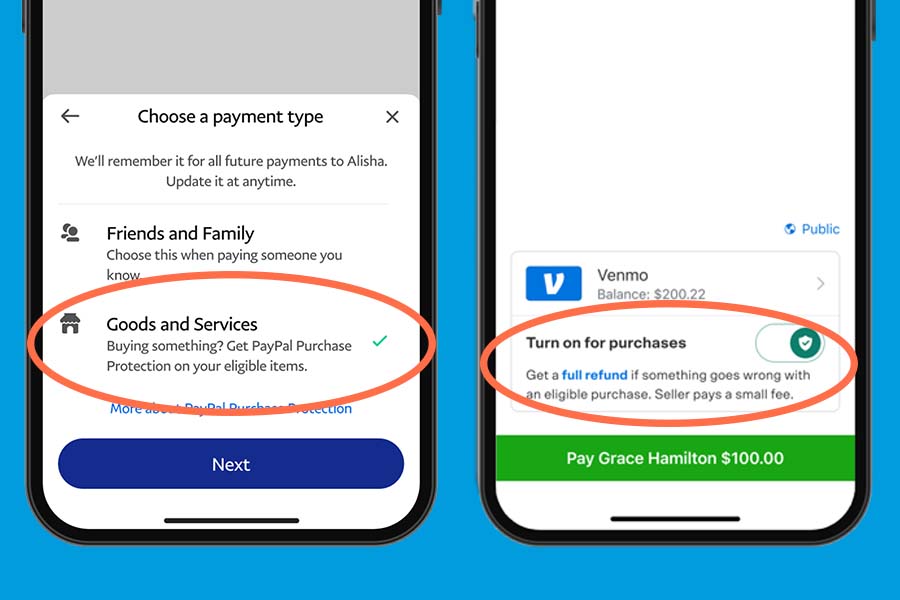

This change should not impact how you use PayPal and Venmo. You can still continue to use the PayPal and Venmo platforms as you do right now, and the benefits that are offered by sending money via our goods and services P2P feature – including buyer and seller protections on eligible transactions for

PayPal and

Venmo.

Q: What information do I have to provide to PayPal and Venmo? What do I have to do to ensure I remain compliant?

In the coming months, we may ask you to provide tax information like your Employer Identification Number (EIN), Individual Tax ID Number (ITIN) or Social Security Number (SSN), if you haven’t provided it to us already. For background, generally businesses use an EIN, while sole proprietors and individuals will use an ITIN or Social Security Number.

Q: Why is this happening now?

The 1099-K reporting requirement was part of the American Rescue Plan Act of 2021 passed earlier this year by Congress and signed into law by the President. The effective date for these new changes is January 1, 2022.

Q: Where can I find more information?

Here are some further helpful resources if you wanted to read more:

Disclaimer: PayPal does not provide tax advice. This content has been prepared for general informational purposes only and is not intended to be relied on for tax advice. For questions regarding your specific circumstances, you should consult with a tax advisor.