?Just invade you missed it Tripolar Inbred Chuckles???

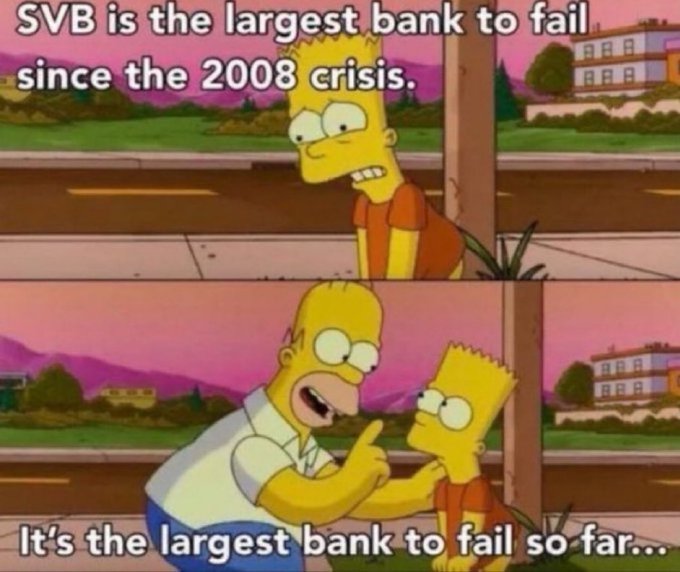

Bank Failures: Ignoring the 800 Ton Elephant Erasing Your Money

March 20, 2023

OUTRAGEOUS: Biden’s Bailout of Silicon Valley Bank Helped Save Investment Flow to Sensitive Chinese Aerospace and Defense Ventures, March 17, 2023

Economic Study: 186 US Banks Are in Trouble and at Risk of Insolvency – May Collapse Like Silicon Valley Bank, March 18, 2023

Must Watch: FDIC Bankers Discuss ‘Bail-Ins’ To Deal With Impending Market Collapse, Jan. 1, 2023, “Federal Deposit Insurance Corporation (FDIC) officials recently discussed how to deal with the next approaching market collapse and hide alarming data from depositors to prevent bank runs, video of a meeting shows.”

The Global Financial System Is Already Doomed And The Collapse Will Be Terrifying, Feb. 25, 2023

The Federal Reserve Is the Root Cause of the Banking Crisis, March 17, 2023

Banking Solvency Problems Are Everywhere And The Backstop Guarantee Is Worthless, March 16, 2023

The Great Bond Bomb Was Ticking So Loudly No One Could Hear It Over Its Own Noise, March 17, 2023, “Their hubris. SVB had well over a year to prepare its portfolio to engage with the Fed’s decision to lift the yields on Treasuries, but it took no action to do so. At the time of its collapse 55% of its assets were still invested in bonds, mostly at low-interest rates available over the time when they acquired those bonds that are impossible to sell without a loss when interest rates rise. 47% of SVB’s assets were in long-term bonds (over 5 years to maturity) — the kind that fare worse when you have to trade them during a time when rates have risen!

“Tim Gramatovich, chief investment officer at Gateway Capital, told Insider that even though the Fed has been raising interest rates for a year, it was as if a higher-interest-rate landscape came as a surprise for SVB. “For a $200 billion bank to have no interest rate risk controls is staggering,” he said. “And of course, the regulators and rating agencies are allegedly engaged here too. Doing what, we aren’t sure.”

Biden’s banking busts include this single biggest monetary policy mistake in half a century, March 16, 2023, “Three days before Silicon Valley Bank collapsed, Treasury Secretary Janet Yellen cautioned that climate change puts the banking industry at risk. Yellen was in la-la land, speculating that future storms and tornadoes could diminish the value of banks’ assets.

“Weather is a risk, but she was oblivious to the much more immediate problem facing banks — the plummeting value of the bonds they own. She was heedless to the impending downfall of SVB and possibly several other small banks that had purchased long-term bonds when interest rates were near zero.”

THE MAIN CAUSE OF INCOME INEQUALITY, 2020, “This is undoubtedly the most comprehensive presentation of the history of our money system and who is responsible for the disastrous consequences that has left us with an unconstitutional money system and multi-trillion-dollar debt.” – Dr. W. Cleon Skousen, author of The Naked Capitalist and The Naked Communist.

Mass Layoffs Come To Wall Street: Citi Fires “Dozens” Of Investment Bankers, Nov. 8, 2022

Amazon Layoffs Are 50 Percent Higher As Retail Apocalypse Intensify – Video

The Technocrats Exposed: Almost 70,000 Layoffs in Big Tech so far in 2023 as Techno-Prophecies Fail, Jan. 29, 2023

The Entire World Financial System Is On A Knife’s Edge, Feb. 9, 2023

Retail Collapse: Over 800 Big Stores Set to Close Due to Inflation, Crime, Interest Rates, Feb. 22, 2023

Global Debt & Death Spiral – John Rubino, Feb. 11, 2023

What’s Happening Now Is Exactly What Happened Before The Panic Of 2008 And The Dot-Com Bust, Feb. 17, 2023

Subprime Auto Lender And Used Car Retailer Collapses As Distress Cycle Finally Arrives, Feb. 27, 2023

Bankruptcies Absolutely Soar As America’s Absurd Debt Bubble Begins To Implode, March 1, 2023

We Just Witnessed An Economic Red Flag That We Haven’t Seen Since 1981, March 8, 2023, “The greatest debt bubble in the history of the entire planet is starting to burst, and the whole world will soon be experiencing severe pain as a result.”

“It’s Going To Bite Us” – Upside-Down Auto Loans Surge, March 3, 2023

Status of the Everything Bubble Created by the Fed, March 11, 2023

US Discusses Fund to Backstop Deposits If More Banks Fail, March 11, 2023

44 Million Americans Are On The Brink Of Eviction As They Can’t Afford Rental Prices

Janet Yellen linked to SVB bank collapse, March 13, 2023

Federal Reserve’s Bank Rescue Could Inject $2 Trillion of Liquidity, Raising Inflation Concerns, March 16, 2023

Is This Why Gavin Newsom Wanted SVB to Get Bailed Out?, March 16, 2023

BIDEN ECONOMY: Emergency Loans to US Banks Reach Highest Level Ever This Week – Smashing 2008 Record, March 17, 2023

Federal Reserve to Raise Interest Rates 25 Basis Points Amid Banking Crisis, March 17, 2023